- Billionaires have become central to the Democratic primary race – thanks to both their donations and their taxes.

- A wealth tax, like the ones proposed by presidential candidates Sen. Elizabeth Warren and Sen. Bernie Sanders, would make ultra-wealthy Americans pay the federal government a small percentage of their net worth each year.

- Former New York City Mayor Mike Bloomberg proposed a ‘surtax’ on ultra-wealthy Americans’ income that would leave their net worth alone and would bring in much less revenue, but is more feasible than Warren and Sanders’ plans.

- Despite popular support, any bill for a wealth tax would have to overcome opposition in both Houses of Congress, the White House, and the Supreme Court before becoming law.

- Visit Business Insider’s homepage for more stories.

A majority of the American public, a group of ultra-wealthy Americans, and a handful of presidential candidates agree that the US needs a wealth tax to help close the growing wealth gap.

But few people agree on how just how much that tax should be, or how it should be administered.

Three Democratic presidential candidates, Sen. Elizabeth Warren, Sen. Bernie Sanders, and former New York City Mayor Mike Bloomberg, have released their own proposals on how to raise taxes on the ultra-wealthy, and questioned the other candidates’ commitment to ending wealth inequality, because they have yet to do so.

Before Sanders unveiled his plan in September, Warren’s plan was the most commonly cited example of a radical wealth tax. Now, though, Sanders’ “Tax on Extreme Wealth” makes Warren’s “Ultra-Millionaire Tax” “look moderate,” NPR’s Greg Rosalsky wrote. Last week, Bloomberg released his own “New Tax on the Very Rich” proposal for an income-based tax on ultra-wealthy Americans. The catch is that Bloomberg’s proposal isn’t a tax on wealth at all; it’s a surtax on income.

Sanders and Warren both propose instituting a wealth tax, but their plans have some key differences.

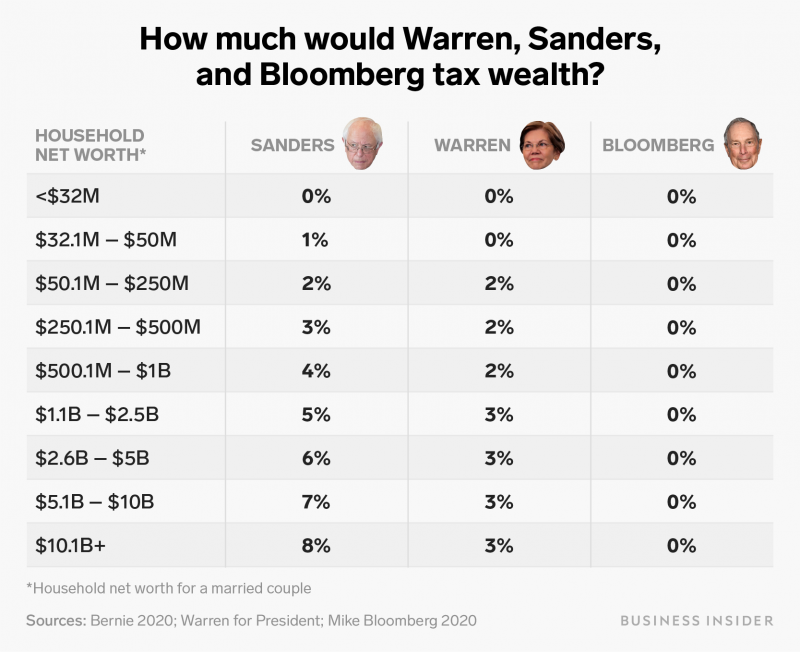

As shown in the chart above, Sanders' plan proposes taxing Americans who have lower net worths than Warren's plan does. The endpoints of Sanders' tax brackets overlap, so for the purposes of this chart, Business Insider rounded to the nearest decimal based on standard tax policy. A married couple with a collective net worth above $32 million would have to pay a wealth tax under Sanders' plan, while couples worth less than $50 million would be exempt from Warren's tax.

The richest Americans - those with a net worth above $10 billion - would also pay 8% in taxes more Sanders' plan, substantially more than the 3% proposed by Warren.

The difference between the two plans is perhaps best illustrated by how much their respective authors say they would raise. Warren's campaign estimates that her wealth tax would raise $2.75 trillion in 10 years, while Sanders' campaign estimates that his tax would raise $4.35 trillion during the same time period.

Bloomberg says he also wants to raise billionaires' taxes - but has a very different idea of how to do it.

The former New York City mayor's tax plan includes raising the tax rate for the highest-earning Americans from 37% to 39.6%, according to his campaign website. That was the tax rate before Trump's unpopular Tax Cuts and Jobs Act took effect in 2018. Bloomberg also proposed adding an additional 5% "surtax" on incomes of more than $5 million a year, according to his campaign website.

The former mayor's plan would likely be easier turn into law than Warren and Sanders' proposals since it is "essentially just adding a higher tax bracket," CBS News' Stephen Gandel reported. Bloomberg's proposal would also be significantly easier for the IRS to enforce since it would eliminate the need to appraise assets such as yachts and fine art.

Any true wealth tax proposal would face substantial headwinds before becoming law, Business Insider reported. The constitutionality of such a tax would likely end up debated in front of the Supreme Court, according to former Department of Justice tax attorney James Mann, who is now a tax partner at law firm Greenspoon Marder. The revenue raised by a potential wealth tax would likely be much lower than its advocates expect because of tax evasion, Mann told Business Insider.

Bloomberg's proposal does trade feasibility for earning potential, however. The "surtax" would net the federal government about $4 billion a year, or $40 billion over a decade, CBS News estimates. The billionaire says on his campaign website that he would spend the funds on rebuilding infrastructure, improving public education, and widening access to health care if elected, but he would have far less to work with than Warren's $2.75 trillion and Sanders' $4.35 trillion over the same time period.

"Mike recognizes the urgent need to address economic inequality in the United States, and as your piece notes, a wealth tax faces significant challenges - and may not work," a spokesperson for Bloomberg's campaign said in a statement to Business Insider. "Mike's plans tackle worsening inequality immediately, using both existing and innovative tools." Bloomberg's proposal for a financial transaction tax would also raise more tax revenue from the wealthy, according to the spokesperson.

Bloomberg himself would pay an additional $1.2 billion in taxes every year on his proposal, according to CBS News, but he could hold on to his existing $62 billion fortune tax-free.

Wealth accumulation in the US would look a lot different under a wealth tax

A study by The University of California at Berkeley's Emmanuel Saez and Gabriel Zucma, published in the Brookings Papers on Economic Activity, found that if a moderate wealth tax had been introduced in 1982, Jeff Bezos' fortune would be half what it was in 2018. Bill Gates, meanwhile, would be $61 billion less rich.

While no such study has been done on Sanders' proposal, NPR's Greg Rosalsky reported that it "wouldn't just slow the growth of wealth at the top. It would essentially stop it."